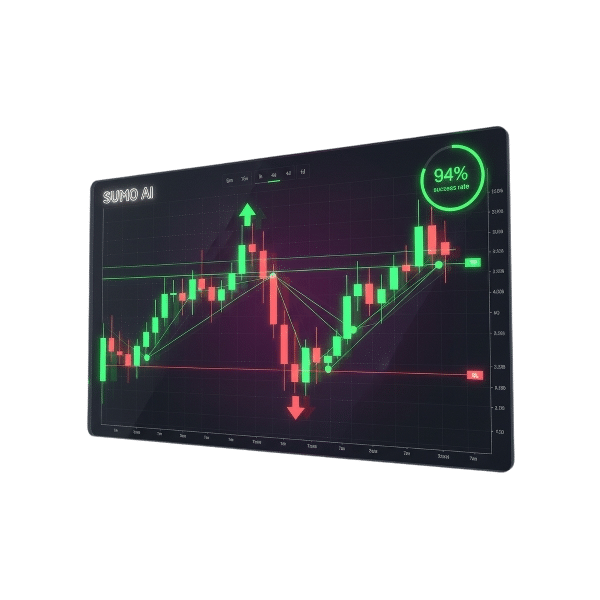

Sumo handles the analysis. You focus on results.

LLM-driven engines scan thousands of markets 24/7, turning raw volatility into clear, risk-aware trade ideas you can execute in minutes – not hours staring at charts.

Structured, risk-aware plans instead of random alerts.

Instead of raw signals or noisy indicators, Sumo delivers complete trade plans – entries, stops, and targets – that plug directly into how you already trade.

AI-powered analysis

Advanced LLM analyzers read market structure, volatility, and sentiment so you don’t have to. Each setup is scored for quality before it ever reaches your screen.

Learn moreMulti-timeframe logic

Dedicated engines for 5m, 15m, 1h, 4h, and 1d keep your entries aligned with the dominant trend – from fast scalps to patient swing trades.

Explore timeframesRisk-first execution

Every idea ships with AI-calculated TP & SL levels, built around ATR and structure to avoid random stop-outs and emotional exits.

See TP/SL engine

How different traders plug Sumo into their routine.

Whether you scalp during volatility spikes or check charts twice a day around a full-time job, Sumo slots into the time you actually have – without asking you to trade like someone else.

The day-job swing trader

Checks Sumo morning and evening, focusing on 4h and 1d swing ideas that don’t demand constant attention.

✓ Scan 1d trend & 4h entries over coffee.

✓ Place orders with pre-defined TP/SL.

✓ Review once after work.

The intraday scalper

Lives on 5m and 15m signals with alerts and bots handling execution, while Sumo’s risk framework keeps position sizing in check.

✓ Real-time short-horizon alerts.

✓ Tight stops & staged exits.

✓ 1h trend filter to avoid fighting the move.

The system builder

Uses Sumo’s entries, TP, and SL levels as a core engine, then connects via API or bot to layer on custom rules and automation.

✓ Structured signals as raw material.

✓ API-ready levels for bots.

✓ Scales strategies without reinventing the wheel.

Our software is available on every device.

Trade from the screen that fits your life – iOS, Android, desktop, or web. Sumo syncs your plans so you can act on high-quality signals wherever you are.

−What instruments and timeframes are supported?

+Are the signals automated trading?

+How do you handle risk management?

+Can I try it before paying?

- What Texas’ recent Bitcoin purchase signals to the rest of the US in a market downturn

- Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

- Why The Bitcoin Bear Market Is Almost Finished

- Here’s what happened in crypto today

- From DOGE to Bitcoin: How fiat accidentally ‘orange-pilled’ Elon Musk

- Bitcoin accumulation trends strengthen as realized losses near $5.8B

- Buy every dip? How pro hodlers blend surgical DCA with rules-based crypto buys

- Bitcoin's ‘momentum is igniting,’ but these are BTC price levels to watch

- Cantor slashes Strategy target by 60%, tells clients forced-sale fears are overblown

- Ether vs. Bitcoin teases 170% gains as ETH price breaks 5-month downtrend

- US investors consider crypto less as risk-taking drops: FINRA study

- Bitcoin Treasury Twenty One Capital to Start Trading on NYSE Next Week With $4 Billion BTC Treasury

- Italy Launches Review of Crypto Safeguards Due to Rising Risks

- 2012 Video Resurfaces of Coinbase CEO Brian Armstrong Pitching What Became America’s Largest Bitcoin Exchange

- Jack Mallers’ Twenty One Capital Wins Approval for CEP Merger, Poised for Public Debut on Nasdaq

- CFTC Opens Door for Spot Bitcoin and Crypto Trading in U.S. Markets

- VTB Pushes to Open Russia’s First Bank-Run Bitcoin Trading Desk as Kremlin Moves to Classify Mining as an Export

- Bitcoin Price Dances with $94,000 as Institutional Demand Fuels a Bullish Setup

- BlackRock CEO Larry Fink Says He Was Wrong About Bitcoin, Reveals a ‘Big Shift’ in His View

- Neopool Reports Record $15+ Million in Bitcoin Payouts to Miners in November 2025

Start small, scale when you see the edge.

Run Sumo alongside your current workflow for seven days. When you’re ready, upgrade into the plan that matches your trading style – monthly, yearly, or lifetime.

Trading cryptocurrencies involves significant risk and may not be suitable for every investor. Sumo provides structured analysis and trade plans, but cannot guarantee profits or prevent losses. Only trade with capital you can afford to lose.